Preface by Lorenzo Bianchi Chignoli

These lecture notes were originally prepared for the Advanced Macroeconomics III course offered by Jordi Galí in the PhD in Economics program at Universitat Pompeu Fabra during the Spring 2025 term. The content is primarily derived from my personal notes from Jordi Galí’s lectures, complemented by key excerpts from his textbook Monetary Policy, Inflation, and the Business Cycle (Galí, 2015, 2nd ed.). Many of the mathematical derivations were worked out as exercises and, therefore, may contain inaccuracies. I would like to extend my special thanks to Vincent D’Anzi and Lorenzo Marzano for their feedback and for identifying several typos. Responsibility for all remaining errors is entirely my own.

Classical Monetary Model

This section introduces a model of money in the classical economy. Most of the attending results are dramatically at odds with empirical evidence. However, this model serves as a smooth introduction to monetary economics, and to some of the notation that will be carried over hereafter. Some of the assumptions of the classical model are, indeed, quite heroic. The main assumptions are mentioned below:

- Perfect competition. To begin with, perfect competition is assumed both in the final good(s) and labor markets. Perfect competition implies that all agents are price takers in all markets, and (rightfully) believe they can sell as many goods as they are demanded at the given wage or price.

- Market clearing. Prices and wages adjust continuously to allow for market clearing (although the mechanism for such adjustment, remains, as usual, entirely unexplained).

- Homogeneous representative agent. Heterogeneity is ignored and a representative household is considered for simplicity.

- Money in the utility function. In this model, money enters the utility function directly. There are several ways to model money demand. In the baseline model, the convenient approach is simply to assume that money holdings provide some services, reflected in the utility function: money figures in the utility function directly, as a transactions facilitator. This means that no utility is derived from “being rich”, although some recent expansions of the model have included such specifications (the so called “rough utility function”). Put simply, its role may be justified theoretically as a sort of “lubricant” for transactions. However, in the continuation of the chapter, some alternative approaches to include money in the household problem will be explored.

- Labor economy. For simplicity, the entire course assumes no capital accumulation and no investment (labor is the only input).

- Closed economy.

Optimality

This section considers a representative household with a general (neoclassical) utility function and derives the optimality conditions in the most generic case. Later on, a specific form for this functions will be introduced — namely, the CRRA utility function. As for money demand,

Consider the utility objective function , where indicates hours of work (or number of workers per household). denote the real balances, that is to say the real value of moneyholdings: . As usual, , and is a preference shock. Utility is neoclassical, and the budget constraint is:

where is the return of a one-period riskless bond with yield defined as for some nominal interest rate . In this economy, households own equity of the firms, and dividends denote real dividends (whenever a quantity is premultiplied by prices, is to obtain nominal balance). Note that households are homogeneous, and therefore shares owned per household can be ignored. To prevent households to borrow indefinitely, that is issuing infinite instead of buying bonds and repaying the debt with new issuance (Ponzi scheme), impose the solvency constraint:

where is total financial wealth, while is the stochastic discount factor. This is the minimal assumption to prevent Ponzi schemes. Since will be decreasing as increases, it implies that household debt cannot increase at a higher rate than the interest rate. Trade in equity could be theoretically included, but households are homogeneous and therefore no trade occurs in equilibrium.

No-Ponzi condition

In this focus, we’ll try to understand why the no-Ponzi condition takes that specific form. The derivation is a (significantly) simplified version of Woodford (2003, pp. 64-72).

The flow budget constraint above relies on the assumption of complete financial markets, i.e. markets that are completely spanning individual households’ uncertainty about future shocks. This assumption is crucial as it guarantees the existence of a unique stochastic discount factor that can be used to price any stream of future payoffs, simplifying the household’s problem significantly. While this course involves a production economy, let us adopt a more general notation also applicable to endowment economies. The flow budget constraint can be rewritten as (money is absent, as if we’re in the cashless limit of a monetary economy). Assume a natural borrowing limit. A household is solvent if its financial assets are sufficient to cover all its net liabilities: It cannot borrow more than the present value of its entire future stream of non-financial income. Then:

Note that the notation is not casual: this denotes the nominal stochastic discount factor, which is exactly the random variable used to price at time any asset with return equal to 1 at (in the case of bonds, ). To continue, iterate the standard flow budget constraint from period to some future period , obtaining the finite-horizon budget constraint:

Continue by taking the infinite-horizon limit:

that is, the expected present value of the household’s financial assets in the infinitely distant future cannot be negative. Define the real stochastic discount factors as the nominal stochastic discount factor adjusted for prices, . Thus:

which is equivalent to the original equation (after the addition of cash).

There are three optimality conditions, which will be derived below:

Government Budget Constraint

Note that, if a public sector were to be introduced, this model should also satisfy the government budget constraint:

which implies a fiscal policy rule determining and a monetary policy rule determining . The implicit assumption throughout this section is that .

For the derivation, assume the household follows an optimal plan and consider deviations for such plan. Provided that the plan was optimal in the first place, deviations must necessarily decrease utility. This method is usually referred to as the variational approach and can be very handy in solving optimality conditions along multiple variables. First, consider deviations in consumption and labor, that is satisfying the relationship :

The second equality follows from the fact that : since no changes occur in the equity market, all additional income has to be spent in consumption. Moreover, perfect competition in the labor market implies that the household believes to possibly supply as much labor as they like. Thus, the terms in brackets must be 0: for negative or positive values some improvement would be possible by changing labor or consumption, violating the assumption that the household is on the optimal path — a contradiction. As a consequence, the marginal rate of substitution between consumption an labor must be equal to the wage to price ratio.

Now consider diverting consumption today with consumption tomorrow. Consider both the cases where household employs money and bonds to increase their consumption. If such deviations are performed using bonds, then it must be that . Rearranging, this is the same as . Therefore, factorizing :

Finally, consider such deviations using money, that is satisfying . Rearranging, this is the same as . Also recall that, by definition, , and thus it must be that . Plugging in these two results, note that:

where the last equality is obtained by exploiting the previous optimality condition: in fact, . This condition indicates the marginal utility of real balances must be equal to, approximately, (can be easily seen by doing a first-order Taylor expansion around 0). The interest rate can be interpreted as the “cost” of holding real balances, namely the opportunity cost of holding real balances in opposed to holding wealth in the form of bonds. Note that his equation only appears in models with money into the utility function.

Let us continue by specifying a structural form for households’ utility. Assume that utility has a CRRA shape (note that, for the sake of simplicity, and have the same parameter), and a constant Frisch elasticity of labor .

The preference shock multiplies the entire function: in this formulation, we can interpret such shock as a pure demand shock. In some sense, it can be interpreted as equivalent to a shock to . Other sources of shock can affect labor supply specifically (see in the slides) or the money demand shock (in the slides, ). Another important assumption is that the impact of real balances is separable. This not innocuous assumption means that the marginal utility of consumption and the marginal disutility of labor do not depend on real balances: . By plugging in the specific derivatives of the functional form is the utility function leads to the implied optimality conditions:

Assume a steady state with constant inflation and no trend growth such as which implies . The corresponding log-linearized optimality conditions are:

where denotes the semielasticity of money demand. In the most general form, the money demand function is postulated as equal to , where is the semi-elasticity of money demand. This form is also derived in the following exercise, as the optimality condition for a utility function with direct utility from real balances. Details on the derivation of the Euler equation as a first-order approximation are outlined after the following exercise.

Household Optimality through the Lagrangian

Set up the intertemporal household maximization problem supposing CRRA utility with preferenze shocks , where :

subject to

This can be conveniently solved through a Lagrangian:

where the expectation term was omitted for readibility. Note that the multipliers must be normalized by the price level. The FOCs are as follows:

Plugging into leads to the first optimality condition:

while the second optimality condition follows pluggin and into :

Finally, we conclude the exercise by considering a generalization with (separable) money demand in the utility function.

The money demand optimality condition is obtained plugging in and for the multipliers:

which corresponds to the formula present in the textbook, namely .

As proposed thereof, the first-order Taylor expansion can be used to approximate the log-linear form (up to an uninteresting constant) as , where is the implied interest semielasticity of money demand. This can be noticed by expanding the last term of:

Take a first order expansion by noting the the first derivative of is equal to . Therefore, the first-order Taylor expansion of the loglinear equation around some yields:

This can plugged into the original equation:

which identifies . Also note that, for small , then , so that .

To find the intertemporal Euler equation espressed in terms of the interest rate, take the optimality condition for in logs:

where the fourth line introduces a first-order approximation (by Jensen’s inequality), as the logarithm is moved within the expectation.

Certainty-Equivalent First-Order Approximation

This Focus details why the common approximation is a first-order Taylor approximation. We analyze the relationship by performing a Taylor expansion of the function around the mean of , denoted as . The variance is . The term is exactly . The term is analyzed by expanding inside the expectation:

A first-order (or certainty equivalent) approximation deliberately ignores all second-order and higher terms. By truncating the expansion after the first-order term, the variance term disappears:

This leads to the final result:

Certainty Equivalence First-Order Approximation

At the first order, and are approximately equal because we intentionally ignore the term that captures the effect of variance.

The ignored term, , is the “gap” explained by Jensen’s Inequality. For a concave function like , , which explains why . Setting this term to zero is the mathematical basis of the approximation.

The effects of the two exogenous shocks on equilibrium values are different. On the one hand, only affects the real interest rate . In contrast, technology has an ambiguous effect on employment depending on : if it is less than 1, increasing technology increases unemployment. In fact, for larger output, a low sigma entails a small increase in consumption, which does not offset the increase in labor demanded. This can be observed by taking the log-linear optimality condition of the firm, which solves profit maximization at the given technology:

(the identity of total output on the RHS and real demand on the LHS holds by market clearing). This highlights how prices depend on marginal costs: .

Real and Nominal Interest Rates

A clarification on real and nominal rates. Recall that:

- Put simply, a bond with price which yields 1 has a return . Moreover, define:

- as the gross rate of inflation

- as the real neutral interest rate Since is pinned down by , the real interest rate should be equal to the returns on bonds net of inflation: . Taking the logs, , which is also equal to the familiar .

As a possible interpretation of this relation, note that pure consumption smoothing can be achieved only if the real interest rate equalizes the discount rate. Deviations depend on the value of the real interest rate. How this is realized in practice is beyond the scope of this section: in the future, central banks may allow individuals to hold deposits directly through CBDC, and presumably earn interests on liquidity. A more detailed treatment of CBDC and crypto is contained in Benigno (2025).

Equilibrium

An equilibrium for the Classical model is a steady state clearing markets for goods, labor, and assets at the given technology1:

The previous conditions allow to solve endogenous variables for the exogenous variables and parameters:

Details on the derivations of these equations are put off to Chapter 2.

The Classical model leads to two main neutrality results. After deriving the equilibrium values for the key model variables, we see that these are independent from monetary policy: in fact, no monetary policy rule was required to derive equilibrium. In addition, the equilibrium conditions are also independent from lump-sum taxes and debt. The role of monetary and fiscal policy is thus simply to determine the level of nominal variables. Note that, in theory, two different regimes would allow to determine the level of nominal variables: a Ricardian regime (where monetary policy is active while fiscal policy is passive) and a non-Ricardian regime (the opposite). The latter is mainly known as The Fiscal Theory of the Price Level: monetary policy is inactive, while fiscal policy determines nominal variables. Of course, there is widespread consensus that the Ricardian regime should be implemented to the expense of the non-Ricardian. Regardless of the choice, however, monetary neutrality holds in both, as it hinges exclusively on the separability of real balances.

Unlike real variables, the exact equilibrium values of nominal variables cannot be set without reference to monetary policy. Therefore, let us consider a couple of different policy rules to determine the price level, inflation, and/or the nominal interest rate.

Policy

Exogenous money growth

Combining the money demand equation (or money market clearing condition), that is , with the previous solution for the endogenous values — , , and —, and plugging in the definition of real interest rate (as the nominal rate minus inflation, also referred to as the Fisher equation, it is possible to sketch a rule for exogenous money growth.

Fisher Equation

alternatively written in terms of inflation rather than prices as . In a steady state with perfect foresight, that collapses to:

Thanks to this equation, it is possible to rewrite the interest in terms of real rate and expected inflation in terms of the price level. Starting from the money demand equation:

By mathematical induction, complete the forward iteration:

meaning that, when monetary policy takes the form of an exogenous path for the money supply, the equilibrium price level is always determined uniquely.

Put simply, rearranging terms and in particular collecting on the LHS, the resulting stochastic difference equation collects all the terms independent of monetary policy (real variables) in the term . As solved by forward iteration, it was shown that the price level is equal to exogenous current and future level of the money supply. This is usually expressed in growth rates rather than levels, which explains why its was subtracted from both sides. In the steady state, all the elements RHS are constant: therefore, also is constant. By taking first differences, we get that is constant in the economy:

and therefore:

Inflation responds directly to variations in money growth. The equilibrium price level is a function of money growth, real variables (depending on real shocks), and . Note that the price level should grow more than proportional to the price level, as this positively covariates with the expected money growth: this is radically at odds with empirical evidence. Moreover, real shocks also affect the price level.

As for a solution for the interest rate, use the final line of the price equation and to solve for the first line of such equation, that is the money demand equation:

where . The nominal rate depends on expected rather than current growth rate of the money supply (in addition so some real factors), as this of course affects expected inflation, which positively figures in the definition of nominal rates. This is also the original use of the Fisher equation, where the real rate is constant and the nominal rate reacts to money growth. Note that there is no liquidity effect, which would occur, instead, if the interest rate and the money supply moved in opposite directions.

Interest rate rule

The following rule is a more realistic policy instrument, which resembles more closely the rules used by central banks in actual practice, based on some inflation target. Define a generic interest rale rule as follows:

for and the exogenous monetary policy shifter following an AR(1), where is the steady state natural interst rate. This can be combined with the Fisher equation:

The term must be consistent with the steady state when inflation is at its target . Moreover, is a parameter indicating how much the interest rate reacts to inflation. Restrict the interest to bounded solution, and observed that the solution differs depending on . Suppose and iterate forward:

Put simply, for any exogenous sequence and a given value of , there exists a unique : current inflation is uniquely pinned down by the reaction parameter, and in particular is equal to:

The property of uniquely pinning down the path of the price level is usually referred to as the Taylor principle. In this case, the Taylor principle is satisfied only if the nominal interest rate responds to inflation more strongly than 1 to 1 (i.e., ) thus affecting the real interest rate. This is also known as nominal determinacy.

Taylor Principle

The interest rate rule must enforce a unique equilibrium.

In contrast, if , then the forward iteration of the price equation diverges because either fails to decay (when ) or grows (when ). As a result, no bounded solution exists for inflation. Instead, the stationary solution to ^a243c4 is derived combining ^26558a with ^648e11:

where , introduced in the fourth equality, is a forecast error which is equal to zero in expectation by definition of rational expectations. This implies the system does not yield a unique, stable equilibrium. This result is known as nominal indeterminacy: there are infinitely many inflation paths consistent with rational expectations, depending on agents’ beliefs. Monetary policy is then ineffective at anchoring inflation expectations: since the sum does not converge, this equilibrium is not bounded, and any initial value is compatible with equilibrium. That is, expectations alone can determine inflation outcomes — without a unique path imposed by policy. An example is that of stochastic equilibria, usually referred to as sunspot equilibria, which would in this case be represented as (nominal indeterminacy).

Price level rule

Consider an interest rate rule based on the price level rather than inflation, for , where is the log price level, and is the target (steady-state) price level. Combining this with the Fisher equation we get:

a forward-looking difference equation. Iterating forward:

As long as , the term decays geometrically, ensuring that the sum converges and unique bounded solution for exists. This means that any positive reaction to deviations in the price level is sufficient to pin down a unique, stable path for the price level.

Optimal Monetary Policy

To find the welfare-optimal monetary policy, start as usual by solving the social planner’s problem. In particular, start by characterizing the allocation that solves such problem, which is typically the efficient allocation. Finally, try to come up with policy rules that implement such allocation in the decentralized equilibrium.

The social planner’s problem appears as subject to , which means the only restrictions are i) technology and ii) the resource constraint. Note that, while the the social planner faces a static problem, households believe they can transfer resources from a period to another: this is not possible for the economy as a whole. By substitution, rewrite the problem as and take the FOCs:

Can the solution given by the first order conditions be replicated in the decentralized economy taking prices as given? First, consider the efficiency condition: this is always satisfied, regardless of monetary policy, since the marginal rate of substitution equals the real wage, and by the optimality condition of the firm the real wage equals the marginal product of labor (both results follow from perfect competition). The central bank should thus worry about the second condition. Let us compare it with the optimality conditions for households:

Then, for to be 0, it must be that the interest rate itself equals zero, that is at all times. The result stating that the optimal interest rate rule prescribes 0 nominal rates at all times is known as the Friedman rule. The intuition behind this rule relies on a basic welfare principle: the private cost of using some resource or service should be equal to the social cost of producing such service. Applying this to real balances, the social cost of producing real balances (although not been explicitly stated) it was implictly zero: no production function was required to produce money. Since the social cost of producing money is zero, consider the individual cost of holding real balances: these are equated only if the nominal interest rate is 0.

One weird implication of the Friedman rule is that average inflation will end up being negative. In fact, in the steady state, : however, since , then , which induces deflation, at least on average. This is at odds with actual practice, as most central banks have, in contrast, a small positive inflation target.

Suppose a central bank follows the Friedman rule. This is an example of passive monetary policy rule, which implies inflation indeterminacy: . The equilibrium is, thus, not unique (nominal indeterminacy). After all, would a central bank care about nominal indeterminacy in the setting of the classical model? Theoretically not, as nominal variables do not affect utility in any ways. High volatility in the price level would, in other words, be irrelevant for utility. However, as soon as we suppose — even exogenously — that the central bank wants to avoid indeterminacy, then how to satisfy this with the Friedman rule? In equilibrium, any sequence satisfying should be implemented with uniquely determined. To obtain this, take the deviations from the target 0 and make that interest rate deviation proportional to the inflation deviation from the target:

for some satisfying the Taylor principle. If the follows this rule, the Friedman rule will effectively be implemented: iterate one period forward, and take expectations of both sides of the equation:

whose only bounded solution is so far as the Taylor principle is satisfied, without being explosive.

Non-Separable Real Balances

So far, the assumption of real-balances separability was crucial to ensure neutrality of monetary policy. However, if changes in real balances affect the marginal utility of consumption or disutility of labor, then real balances will also affect consumption or labor supply and thus be non-separable. Suppose that the marginal utility of consumption is affected by real balances:

The labor supply schedule becomes:

Assuming that prices, wages, and consumption are constant, differentiate with respect to employment and money demand:

which implies:

Suppose that the increase in real balances affects positively the marginal utility of consumption and labor, i.e. the cross derivative . If real balances decrease the marginal utility of consumption, then the labor supply shifts to the left: it contracts, as the incentive to work is smaller. Neutrality will not hold: an increase in the interest rate generates a recession (decline in output, increase in unemployment). The opposite occurs with negative cross-derivatives. Positive cross-derivates are, however, a more realistic assumption: not only this holds empirically, but also makes logical sense. In fact, if consumption is high, the marginal utility of maintaining real balances in your pockets should be higher than employment, since employment is aimed exactly to getting even more consumption. To continue, suppose that the inflation target is raised permanently to a higher level, with a correspondent increase in the nominal rate and thus a permanent decrease in real balances. Then, the previous effects become permanent: monetary policy affected economic activity. This is fact is known as non-superneutrality of money. A model where inflation has a permanent effect on economic activity, a very strong result, satisfies the stylized fact that monetary policy is neutral only in the long run. However, calibration and simulations provide results that are not consistent with empirical evidence.

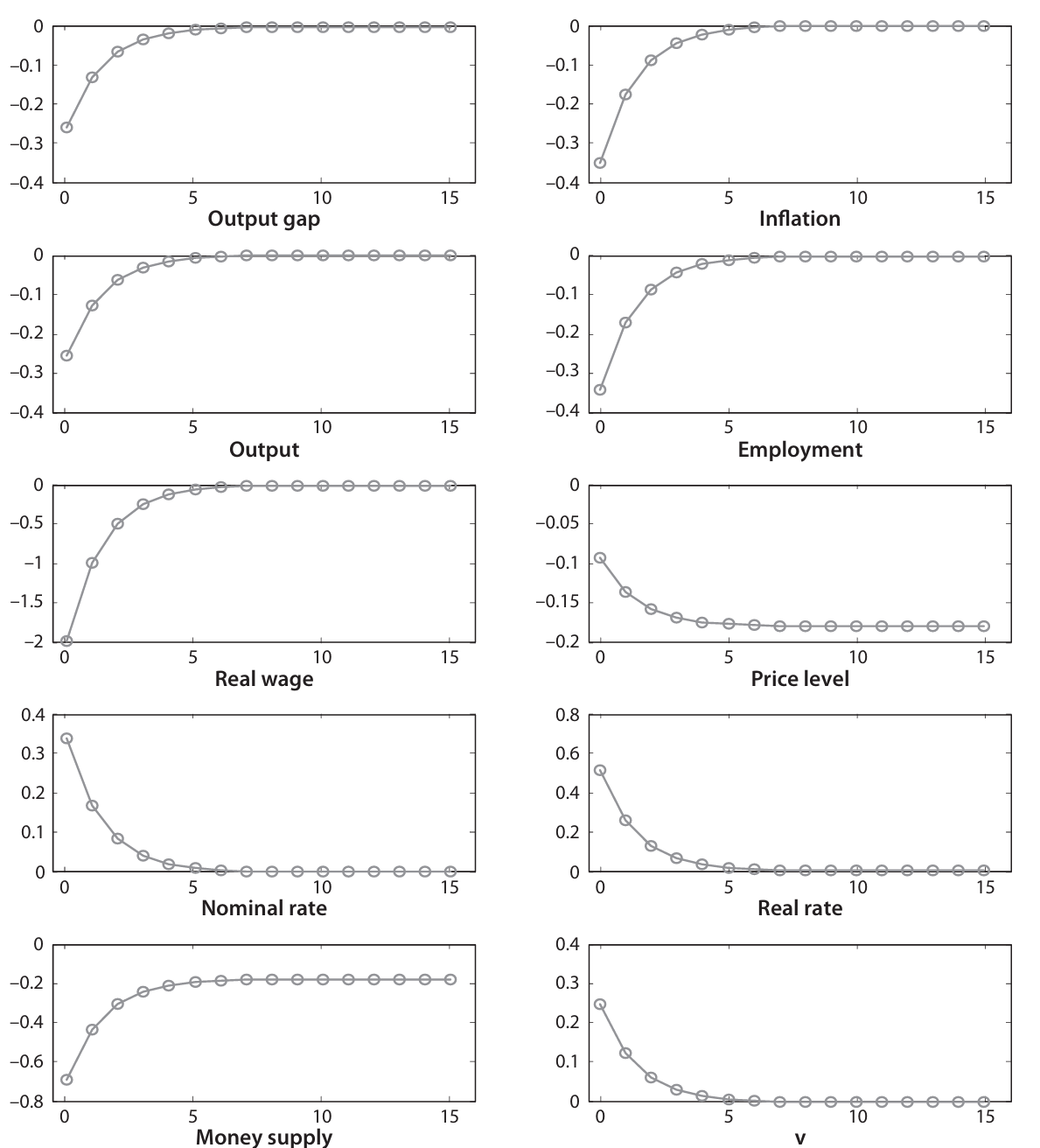

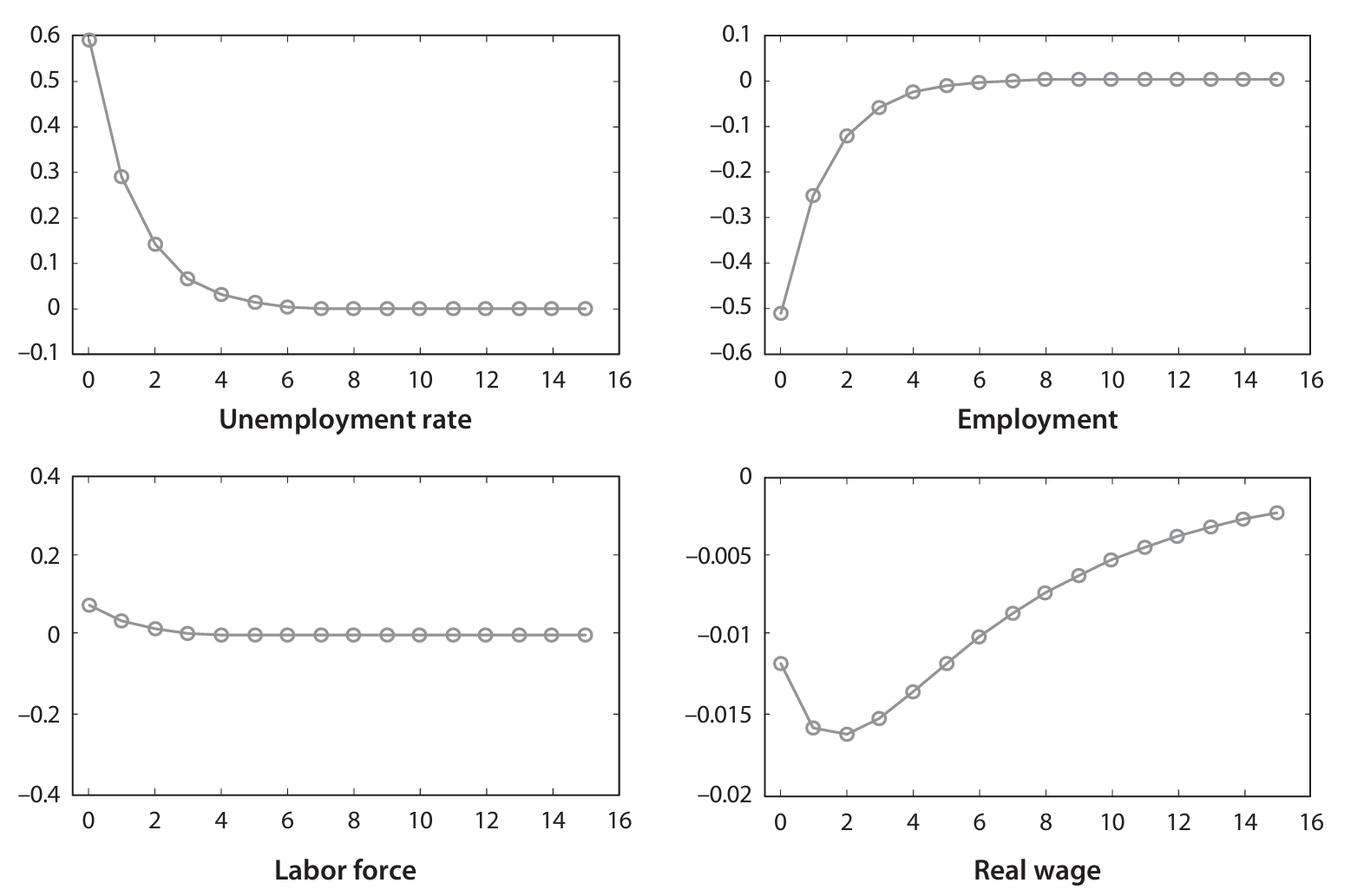

To summarize, calibrated models with non-separable real balances exhibits quantitatively small non-neutralities, large effects of monetary policy shocks on prices, and absence of liquidity effect. An example of non-separability is provided by Walsh (2017). The author specifies a nonseparable utility function, calibrates the model and provides some impulse-response functions to a positive money growth rate shock.

.-Figure-2.4.png)

Expansionary monetary policy raises the nominal interest rate — consistently with earlier predictions: higher inflation expectations raise the nominal interest rate. Such an increase contracts labor supply and induces a recession, with lower output and employment. Inflation increases significantly: a 1% shock induces a 2-3% increase in inflation. The real money supply goes down as a result. The unpleasant result is that this model has no liquidity effect: a positive increase in money growth is associated with a positive increase in interest, which is not there in the data. Inflation responds basically immediately, which is also false in the data. An increase in the money supply induces a recession, false in the real world. Finally, and devastatingly, the non-neutrality is tiny: an increase in 1% money growth rate, which leads to a substantial increase in the interest rate, leads to a reduction in output of 0.0something percent, not even captured by the statistical agencies. With non-separable real balances calibrated consistently with empirical estimates of money demand, non-neutralities are very small compared to empirical evidence. This led the literature to cast aside these models for practical purposes.

Alternative Micro-foundations for Money Demand

There are alternative ways to generate demand for money.

- Shopping time models micro-found the demand for money, since leisure is equal to 1 (time endowed) minus the time spent at work and the time that is required to shop: . This depends on the shopping technology : real balances facilitate the transactions. Thus, holding real balances increases utility by diminishing the time waste: .

- Cash in advance constraints induce demand for money by introducing an additional constraint: consumption expenditures cannot be larger than the amount of money carried over from the previous perdiod (and cash government transfers): .

- Cash vs credit goods, a generalization by Lucas of cash in advance constraints. Suppose Good 1 is a cash good and Good 2 is a credit good: the latter works like consumption so far (no cash in advance is needed, labor income can be directly transformed in consumption), but cash is needed in advance for Good 1. Interesting implications include that changes in inflation effectively affect the relative price of the two goods, distorcing the quantities consumed in an inefficient way (for further treatment, see PS1).

Global Equilibrium Dynamics

In this section, we will briefly consider equilibria further away from the steady state. In such contexts, log-linearization can no longer be used. Consider an economy like the previous one, with . Money market clearing implies that where . Assuming perfect foresight and using the relationship between and inflation, that is or in logs , this becomes . To continue, find consistent steady state paths without linear approximations. A steady state with a constant price level is defined as . Deviations from this can be found by solving for , with the global equilibrium dynamic: . It is possible to verify that and . Note that the transversality condition is violated if the dynamics tend to 0 and in particular if , since is decreasing at a rate and converging to a positive constant. Thus, it is not an equilibrium. In constrast, equilibria at the right of cannot be ruled out in general: thus, hyperinflationary equilibria can be, in principle, admitted. This may hold true even if the money supply is constant: in such cases, the steady state is referred to as a self fulfilling hyperinflation, since individuals believe that inflation is incrasing, leading to higher interest rates and lower demand for money, so as to increase the price level. It turns out, however (see Obstfeld and Rogoff, 1983), that these explosive equilibria can be ruled out with a single condition, known as the Obstfeld Rogoff condition: which is easily satisfied (even with log-utility). An interpretation consistent with the Walsh figure is that, for a finite , then becomes basically vertical, so that no finite price level is consistent with the equilibrium.

The Fiscal Theory of the Price Level

An unorthodox monetary theory about price determination is the fiscal theory of the price level. In this case, monetary policy is passive, but fiscal policy determines nominal variables. Thus, is exogenous (constant), there is an exogenous gross constant real interest rate , and assume perfect foresight for simplicity. The period government budget constraint is:

where denotes the primary surplus. Note that the government exerts seignorage of size . By forward iteration:

were we exploited the transversality condition (solvency constraint combined with optimality). For any exogenous , the government’s intertemporal budget constraint (G-IBC) uniquely determines . Take an example of passive fiscal policy, that is for a :

The Classical Model and Empirical Evidence

In previous years, the ECB initially adopted the “monetary pillar” for monetary policy, that is it targeted some reference value in the growth of M3 at around to 4.5%, with the aim to pin down inflation anchoring money growth. Despite evidence suggesting that money growth transmits on inflation, it is however not possible to pin down inflation uniquely by controlling the money supply. The Classical model shows that other policy rules, like interest rate rules, can control inflation better than money supply, as the latter can react to many shocks such as money demand shocks. Although it holds in equilibrium that money supply and inflation are related, this is not a direct connection that should be leveraged upon, especially off-equilibrium.

As regards the short run, some predictions of the classical model are too strong and rebuted by the data. Consider the effects of exogenous monetary policy shocks, that is a policy which is not elicited by the economy but imposed exogenously. The paper considered is Christiano, Eichenbaum and Evans (1999), focusing on the federal funds rate — the U.S. main instrument for monetary policy. Suppose for practical purposes that the data generating process for the nominal rate follows a linear model: . Obviously, the errors are not directly observable and have to be measured. A natural approach is estimating the rule and then recovering the residuals; finally, take variables of interest and regress these on the value of current monetary policy shocks, as . This allows to isolate the effect of monetary policy shocks from other shocks. Performing this calculation shows that, when the Federal Funds are raised persistently (persistent tightening), GDP also declines persistently. Second, in the short run, the GDP deflator hardly changes and declines eventually more slowly. Finally, the measure of money supply declines persistently. The key takehome message is that the response of the price level is basically unresponsive of the Funds rate. Moreover, the Classical model predicted no liquidity effect (oney supply and interest rate moved in same direction). Empirically, the opposite occurs: money supply and interest rates move in opposite directions.

Liquidity Effect

Liquidity effect refers to the money supply and the interest rate moving in opposite directions.

Similar results are obtained by Jaroncinski and Karadi (2020), focusing on the 30-minute window span when the Fed announced rates.

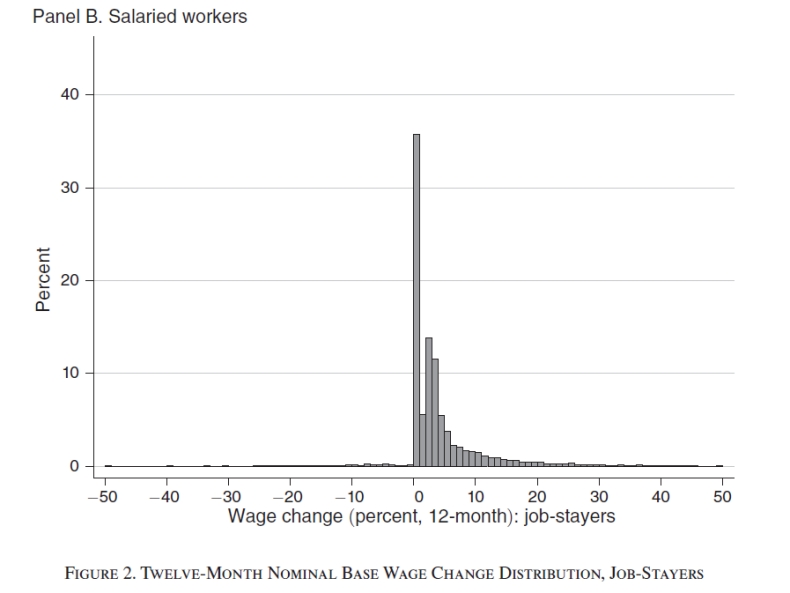

Sticky Prices: Evidence, Microfoundations, and Early Models

Microeconomic evidence can help in grounding the patterns followed by individual prices. In particular, it is observed that there are some goods (manufacturing goods, both durables and nondurables, and services) whose prices remain constant for significant amounts of time, and occasionally change discretely in some direction. In contrast, prices for food and energy change more frequently, almost continuously in some cases. In what follows, then, we will focus accordingly on sticky prices. Stickiness refers to the frequency of price changes: the fraction of firms that adjusts the price of individual goos (or the fraction of goods whose price is adjusted in a given month). Empirical evidence suggests that only 12% of prices are adjusted every given month! Moreover, prices in the EU are in general more flexible than the US. Some literature (including Benigno) suggests that more emphasis should be put on stickier prices, and when these start adjusting more frequently, triggering serious inflation spirals. However, only recently did we start collecting data on price changes, and for most of the time inflation was very flat (this changed with the COVID inflation surge). Nakamura, Steinsson, Sun and Villar (QJE, 2020) still tried to reconstruct price adjustment back to the 70s, and realized that the frequency of price change correlates almost by 0 when inflation is low; however, when inflation is triggered, there is a significant positive correlation. This was confirmed in a ECB Economic Bulletin (Dedola et al. 3/2024), while price decreases are absolutely constant and low. Additional evidence in Argentina suggests that low inflation does not affect the frequency of price changes, but when inflation increases then it basically induces more frequent adjustments. Eventually, models of price stickiness assume that the frequency of price changes is constant. However, this is a reasonable simplification only to the extent that inflation remains low and steady. To model episodes of higher inflation, then the sticky prices models would not be appropriate.

Microfoundations for Price Stickiness

In the 80s, microfounding macroeconomics was popularized as a key issue and the main priority. Price stickiness is no less microfounded, as will be showed in this section. Let us consider a firm that sets prices independently, moving away from the assumption of perfect competition. Suppose their profit function is given by , where and is a profit shifter. Real profits for firm depends on the relative price of the good, and shifts the profit function, interpreted as aggregate output. Standard neoclassical assumptions include concavity with respect to prices, that is . The optimal price setting condition requires that: while the optimal price adjustment in response to is as follows:which implies, by multiplying and dividing by the level of :

where is an inverse index of real rigidities. Put simply, if is large, real rigidities are small; if are small, there are large real rigidities. Let us consider the economy as a whole, with many identical firms in a symmetric equilibrium. Relative prices must sum up to 1, which induces the initial equilibrium as a symmetric equilibrium with flexible prices , which pins down . A small change in the profit shifter induces a new optimal price when other firms do not adjust, for any reason. has not changed, but relative prices are affected. Approximating near the optimum when firms do not adjust:

Thus, the gain from price adjustment when other firms do not adjust is equal to

If we assume that , then ; since other firms do not adjust, and thus . Rewrite the previous as

that can be also interpreted as the opportunity cost of not adjusting the price. The effects on profits are of second order, normally smaller the flatter the profit function is. The stronger the real rigidities, the smaller the and thus the smaller the potential profit gain.

However, suppose there is a menu cost, a small cost of adjusting the price. This menu cost may be small, but still larger than the losses for not adjusting the prices. In such cases, firms choose not to adjust the price, and this is an equilibrium. In such cases, inflation is 0 and output changes in proportion to the money supply: the change in money supply has first order real effects. This is more likely to happen for small , weak concavity of the profit function, and the smaller the shock . If the marginal product of labor is higher than the marginal rate of substitution, as it normally is (due to market power, distortionary taxation, and other practices that make the level of economic activity lower than efficiency), then the economic outcome of increasing money supply has first order welfare effects (that is, effect of the same effect of the change in money supply). The salient result is that tiny, second order menu costs are sufficient to induce first order real effects of monetary shocks.

Multiple equilibria may arise if other firms adjust, and firm does not adjust its profits. Then, these are given by . Approximating around :

Which implies a gain from price adjustment when other firms adjust equal to

Note that multiple equilibria may occur if the following condition holds: or equivalently .

A Model with Price-Setting Advantage

The classical reference for this is Blanchard and Kiyotaki (1987), although we’ll consider Romer’s (2019) version. Consider the usual infinitely-lived utility maximizing households with objective function , where . That is, is an index of the quantity of good consumed for a continuum of goods , where the CES function suggests that goods have some degree of substitution elasticity . As usual . The usual resource constraint and cash-in-advance constraint hold:

together with the usual solvency constraint

where

The important feature of the model is that firms set prices before economic shocks occur, and once these happen firms are stuck to their prices for one period. This one period delay is the main source of price stickiness. Last, money demand will be introduced as a cash-in-advance constraint. This and the budget constraint appear as in the classical model, with the only difference in the consumption integral.

Household optimality

In a first stage, solve the problem of optimal allocation of expenditure. For every given consumption index, it is optimal for the households to minimize the expenditure in order to obtain such level of consumption for each specific commodity, subject to attaining the level of final consumption index : that is

It can be shown that the optimality condition is satisfied given the following implied demand function for each good:

where . The additional implication is that the implied demand function satisfies the following condition, so as to be written conveniently as

allowing to tread the problem as if there were a single good.

Price Level

The aggregate price level is defined as:

Raising both sides to the power of :

Substituting this back into the expression for :

In a second stage, determine optimal consumption, money supply and labor demand. This is the same problem solved in the classical model, with the additional assumption that the nominal interest rate is positive (in equilibrium) and thus the cash in advance constraint will always be satisfied with equality. Set up the Lagrangian:

with FOC:

which holds for all (the derivative has been derived exploiting the property of the Dirac Delta, here denoted as , of integrating to 1). Note that:

which allows to compute the aggregate demand for consumption goods:

Recall that the households optimality conditions are as follows:

Moreover, it can be assumed in equilibrium that , and thus . Assume the conventional CRRA utility function and derive the log-linearized optimality conditions:

Firm optimality: Flexible prices

The firm problem changes as the firm can set the price, subject to a demand constraint (monopolistic competition). As will be shown below, the optimality condition is equal to the desired markup times the production cost given the output. To set up the problem, consider the usual technology and define the (log-linearized) wage-to-marginal-product-of-labor ratio:

It is now possible to set up the firms’ profit maximization problem subject to the cost function :

as previously derived. To obtain the optimality conditions, take the derivative of the objective function with respect to , equate it to 0, and then produce the quantity determined by the demand function by imposing the constraint:

which leads to:

Two new objects are hereby introduced:

- the desired markup

- the marginal cost of labor , which is firm-specific as different production level may induce different marginal costs. Note that the previous result implies that the desired markup is constant and equal to

The optimality condition of the firm can be log-linearized, and extended to the aggregate firm sector invoking symmetry:

which compares to the perfect competition scenario as:

To compute the equilibrium, exploit the price setting equation. Recall that, given our production function, the marginal cost is equal to which is log-linearized as . This can be seen as follows:

where is an index of price dispersion and is equal to zero up to a first order approximation (the result is proved below).

Price Dispersion

By definition of :

Note that it can be rewritten , where . Its second order approximation yields:

This can be plugged in a second-order approximation of around 0, that is , so as to obtain:

where . Plugging this into the definition of price dispersion, that is equal - up to a second order approximation - to:

Thus:

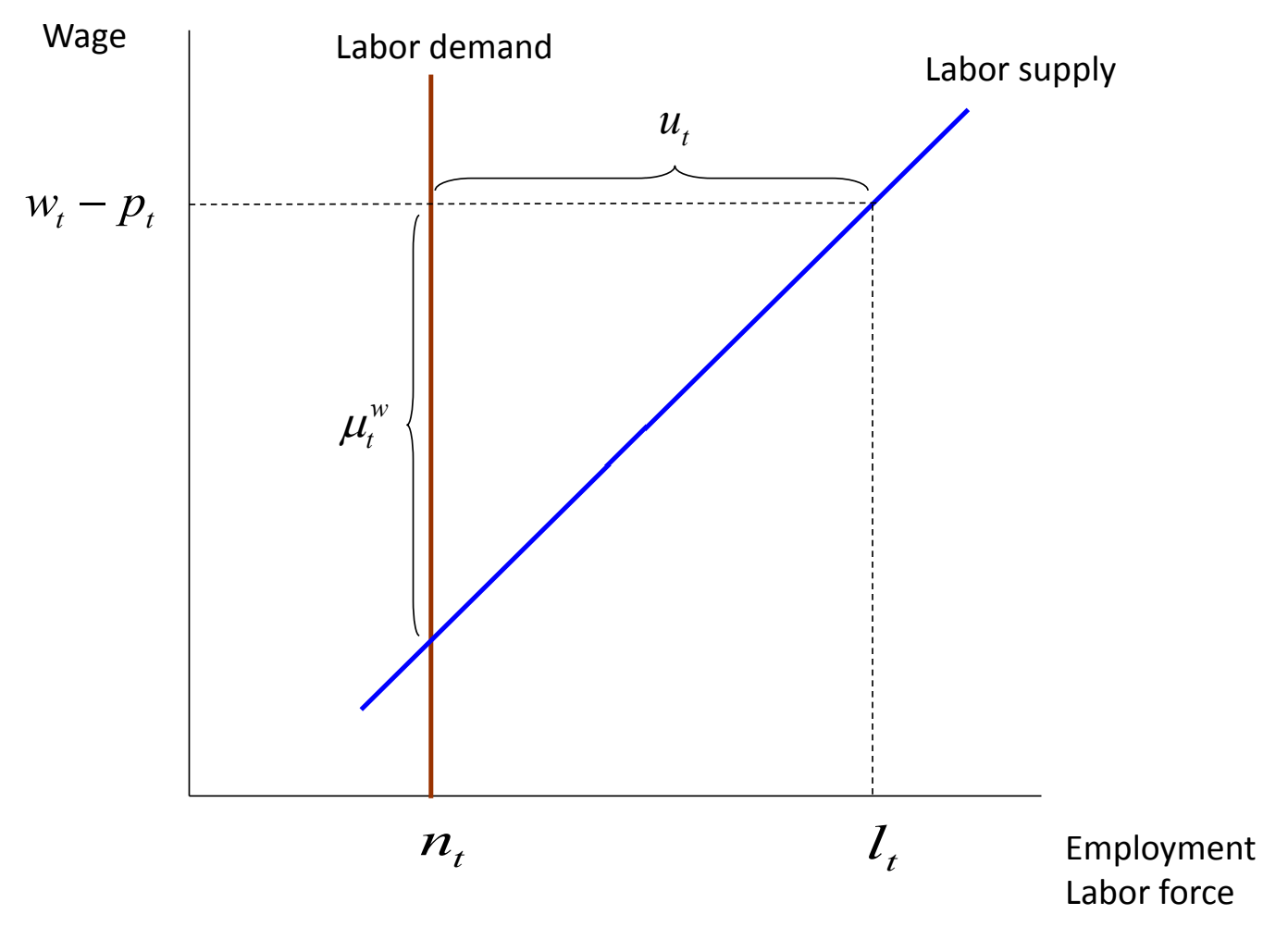

where the equalities in line 2, 3, 4 and 5 follow respectively from the definition of , from the household optimality conditions at ^1fa0f4, from market clearing and the technological constraint. Recall the goods market clearing condition , and the production function which allows to express labor supply as . The level of output derived under flexible prices can be referred to as the natural level of output and denoted as :

where and . Comparing this expression to the classical monetary model case, note that this is almost identical. The only difference lies in the markup, which of course could not be present in the classical model due to perfect competition. Put simply, the fact that firms are monopolistic competitors does not change the way the output responds to technology shocks. The introduction of market power affects only the mean level of output at the steady state: it lowers the level around which output fluctuates, without changing the response to shocks. As for the real interest rate, this remains totally unaffected, with same mean as before.

Employment, real wages, and the real rate

Compute the levels of employment, real wages, and real interest rate and compare these to the classical model. In the flexible prices monopolistic model, these three quantities are as follows:

which compares to the classical model as follows:

These objects are also referred to as and . Note that the main discriminant of the two is the realized markup, shifting the outcome component of the monopolistic model. However, the real rate is the same as in the classical model, since and are not affected by the markup.

Firm optimality: Nominal rigidities

Now assume that prices are set in advance, that is at the beginning of each period before the shock are realized (sticky prices) rather than at the end of the period in response to just occurred shocks (flexible prices). The new firm problem is as follows:

where . The optimality conditions follow a derivation similar to the model with flexible prices and yields:

or, equivalently, by factorizing out :

where . This suggests a perfect foresight steady steady as .

To log linearize the optimality conditions of the firm, beware not to log-linearize by Taylor expanding around or : these quantities have ne steady state value, and when they are shocked they move permanently. Instead, in order to transform the conditions into state steady variables, divide and multiply by , and express everything in terms of the markup. Note that both and are equal to 0 when evaluated at the steady state, since these are chosen optimally. Find that the firm will set the price so that the expected markup equalizes the desired markup.

where linear approximations have been introduced in the second line and in the sixth line (Jensen’s inequality). A comment on : this is the firm’s nominal marginal cost divided by the aggregate price level and represents a form of real marginal cost. In the steady-state, nominal marginal cost tend to grow with the aggregate price level; thus, their ratio is often stationary, even if the element themselves are not. Symmetry can be invoked so as to generalize these conditions:

and finally to compute the average markup in the economy:

Which differs from the flexible prices case simply by the , which is under flexible prices. Put simply, there is a difference between the average markup and the realized markup, which is defined as the output gap :

Why does markup decrease in output? This is because increased output induces higher wages, and thus consumption and real wage to the labor supply equilibrium. At the same time, the marginal cost will increase - for the same reason, and also due to decreasing returns to labor (). A positive shock to technology increases the markup for any level of output by directly reducing marginal costs. By subtracting the average mark up to output, we obtain the output gap . This allows to rewrite the equilibrium condition as a zero output gap condition in expectation.

Output is in equilibrium at:

where is “innovation” in output. This equilibrium condition can be used to determine output, prices, and other variables. If gap is 0, the expected output attains its natural level (in expectation). This can be determined by its (expected) equation (it is always possible to write down the realized level of output as the sum of the expectation plus to the “surprise” or innovation, as a sort of forecast error). In the resulting equilibrium, price level is predetermined:

In open contrast to the classical model, monetary policy is not neutral through its unanticipated component , which affects output. This non-neutrality has two dimensions: on the exogenous end, monetary policy shock affects output (); as for the endogenous component, monetary policy will also an effect of output, by the affecting choice of (defining such parameter is like allowing for the central bank to react to technology shocks systematically). This is part of the endogenous component of the rule of monetary policy. Therefore, technology shocks affect output in two ways: through monetary policy, and by the marginal cost, but in lag . To see this, consider a money supply rule such as

such that . The output gap is affected by the exogenous monetary shock:

In this model, monetary policy is no longer neutral, finally accommodating empirical evidence. However, it is not such in a very trivial way: monetary shocks only have contemporaneous effects and no persistent effects on output. However, data suggest that the effect of monetary shocks on output is persistent. Since price stickyness has been introduced as lasting for one period only, monetary policy cannot be persistent, as it goes back to the flexible prices results after only one period (other shocks being absent). Another limitation of this model is that inflation has no welfare costs, due to the fact that there are no relative price distortions (all firms adjust samely). In what follows, we’ll consider a model with staggered price setting: at each point in time, only a fraction of firms will adjust prices.

Last, note that with sticky prices the Friedman rule does not hold. The central bank can influence output, and thus will attempt to make the outcome as close as possible as the flexible price equilibrium. This can be done by choosing a rule with , and no monetary policy shocks as these would cancel out. That would be the optimal policy in such scenario. In that case, the output gap would always be at 0, and the would replicate the flexible price equilibrium. However, it is no longer an efficient equilibrium due to the monopolistic competition assumption.

The Basic New Keynesian Model

This section will introduce price staggering, referring to a pricing environment where only a random fraction of firms adjusts prices at every period. This is motivated by the microeconomic evidence previously discussed. As for the rest, continue assuming competitive markets. The New Keynesian model, derived from the previous assumption, is sometimes referred to as the Three-Equation model since it is indeed described by three equations:

These are referred to as the New Keynesian Phillips Curve, Dynamics IS Equation, and Monetary Policy Rule respectively. The policy rule can vary depending on the model specifications.

In this model, it will be explained that the identity between realized and desired markups holds only in the zero inflation steady state, not in every steady state. Whenever the firms markup is, on average too low relative to desired markup, they will steadily increase prices when given the opportunity to do so, but they will be able to do so only occasionally. Inflation will thus be driven by the tension between the realized and desired markup.

Household preferences and budget constraint are the same as before (without the cash-in-advance constraint), with optimality conditions:

In addition to the optimal allocation of expenditure, compute the optimal consumption, labor supply, and money demand, based on the usual optimality conditions as derived in the classical model. We add an exogenous preference shock to the utility function of the households, modeled as an exogenous stochastic process such that , and a money demand shifter :

Note that the assumption of separable real balances is still in place, ruling out any impact of on . Finally, given the CRRA specification that is chosen, these optimality conditions can expressed explicitly as:

leading to the implied optimality conditions:

and their log-linear counterparts:

where the second condition can be derived by taking a first order approximation around a steady state with constant growth and inflation, recalling that in such steady state , and rewriting the consumer’s Euler equation as :

which offers an alternative (but very similar) derivation to the same Equation as ^4f3277 .

With staggered pricing adjustment, an index of price stickiness must be introduced: this is denoted as , so that is the probability that a firm adjusts its prices. The implied average price duration is thus equal to

Consider the price level dynamics with staggered prices.

Assuming a zero-inflation steady state and log-linearizing thereby, the price level follows the adjustment rule

which requires to find in the first place. This can be found from the firm’s optimality conditions, and is derived from the discounted sum of future profits in the firm’s objective function (conditional on the price remaining the same in the next period — hence the factor in the sum). This calculation is performed in the following paragraphs.

Positive Inflation Steady State

Reformulate the firm problem so as to account for a positive inflation steady state:

where denotes the steady state level of inflation and is a parameter denoting the indexation intensity (0 to 1) for firms that do not reoptimize prices over the current period. The problem solves for: And the price setting dynamics are:

This implies the following relation, in levels and log deviations:

which implies that inflation is less sensitive to changes in the re-optimizing price as steady-state inflation rises. This effect reflects the fact that, with positive steady-state inflation, firms which reset prices have higher prices than others and receive a smaller share of expenditures, thereby reducing the sensitivity of inflation to these price changes. Indexation of prices works to offset this effect however, with full indexation completely restoring the usual relationship between reset prices and inflation.

Here is a complete derivation of the equation:

The log deviations are obtained as follows. Denote :

Consider the firm’s objective function under Calvo pricing. Let denote the period when was set. Present discounted value of a firm reoptimizing its price in period :

Note that the second sum on the right-hand side cannot be affected by the firm at period . Therefore, the presently relevant part for pricing decision is just:

where the usual . It follows the usual optimality condition:

At a zero-inflation steady state, , implying that the average markup in a steady state with inflation 0 is constant, since all firms have the constant price, quantity, and marginal costs in a steady state (the derivation is similar to ^93467a). Moreover, due to zero inflation, and by steady state it holds that and . Then, the previous condition can be simplified to:

In what follows, log-linearize the condition around the perfect foresight zero-inflation steady state. Put simply, in a zero-inflation steady state, the average markup equals the desired markup, and thus firms are satisfied and keep prices unchanged. The log-linearized counterpart is thus:

where the second line follows assuming a zero-inflation steady state and the solution for a convergent geometric series. Performing the usual log-linear approximation:

Note that the (log) marginal cost for an individual firm that last set its price in period is given by:

Since , it is possible to describe the average marginal cost of the entire economy by summing over firms that last updated their price at for all :

since the term in the parenthesis is the weighted average of log employment over all firm cohorts, which by definition is the aggregate log employment (all firms that last set their price at the same time, , will behave identically at time ). This leads to the following relationship between firm-specific and economy-wide marginal costs:

exploiting the fact that and (why? 2).The previous results can be combined so as to define a new object, the markup gap, which is exploited to describe the inflation environment. Note that, now, the marginal cost is firm-specific (unless the technology is linear): in fact, firms have different prices, thus sell different quantities, ultimately incurring different marginal cost. In what follows, consider linear technology for simplicity. Linear technology is modelled by assuming , so that .

Rewrite equation the previous equation so as to emphasize the role of the markup gap on inflation. Recall that, in the special linear case where , it holds that (this can be easily seen from ^9c8ae2). The markup gap is defined as , and the actual markup is . Combining:

with . Note that the reoptimization price can also be written in a recursive form. In particular:

Leading to:

Finally, combine this results with the equation for the price level dynamics, (and similarly, ). Forwarding one period, note that . Plugging in the previous equation and exploiting the fact that is equal to :

which can be written more concisely by defining :

In order to derive the equation describing the entire inflationary environment, we simply assumed a specific behavior in optimal price-setting (Calvo pricing, i.e. firms can adjust prices with constant probability). No other assumption has been made about competitiveness of labor markets, stickiness of prices, openness or closedness, fiscal policy… This suggests that this equation is very general, and may hold in different environments. Intuitively, it simply states that inflation is the result of deviations of the realized markup in the economy from their desired markup. If the average markup is lower than the desired markup, prices will — on average — raise prices when they have the opportunity, eliciting positive inflation. This relationship is mediated, however, by the coefficient , which crucially depends (inversely) on price stickiness . The stickier the prices, the smaller the fraction of firms that will readjust, and hence the smaller the change in inflation for any given markup gap. Moreover, the markup gap will be more persistent as it will adjust more slowly.

We conclude this section with a final remark on inflation at time , which will not be directly used in the derivation of the NKPC, but is still very insightful. Note that the previous equation is a recursive formulation. In fact, the true equation would be obtained by iterating forward:

which suggests that inflation depends also on expected future markup gaps, since firms realize that the price set today will persist for a possibly long period of time. Inflation depends on current and expected future markup gaps: in this sense, inflation is forward looking. Inflation is expressed as the discounted sum of current and expected future deviations of average markups from their desired level: thus, inflation will be positive when firms expect average markups to be below their desired level .

Real Rigidities

Note that is decreasing in and . Let us try to come up with some intuition for this, putting ourselves into the position of a firm.

With constant returns to scale, the marginal costs are independent on prices (as prices are the driver of demand). However, with decreasing returns, the marginal costs that a firm faces depend on the quantity being produced, and thus on the price. In other words, today’s price also influences future marginal costs, and the firm takes this dependence into account when optimizing. If a firm increases the price assuming that the marginal cost will be higher, the price increase will be slightly less than in the context of constant returns, as the price itself lowers (or increases) the marginal costs. The effects of production technology on pricing dynamics are referred to as real rigidities.

The New Keynesian Phillips Curve

The NKPC is normally expressed in terms of the output gap rather than markup gap. Recall two important results derived in the previous section:

where denotes the output gap.

New Keynesian Phillips Curve

where .

By iterating the NKPC forward:

implying that inflation is purely forward looking and there is no role for past inflation.

NKPC: Outline

Here is a streamlined step-by-step guide to derive the NKPC from the model’s fundamentals:

- Derive Calvo price level dynamics:

- Derive the firm’s optimal resetting price

- Obtain the individual firm’s resetting price from the firm’s problem:

- Compute the values and

- Plug these values into the resetting price: for

- Solve the equation forwarding by one period:

- Plug the resetting price into the Calvo price level dynamics:

- Compute the markup gap for this model specification and plug it into the previous equation.

The previous, very general equation can be combined with model-specific equilibrium conditions (and thus with some additional assumptions) to find aggregate employment and other variables. The equation for the demand for labor can be transformed in terms of output, as in this model output is demand driven. Focus on , take the first order Taylor expansion in equilibrium, and note that it is equal to 1 up to first order. Later on, we’ll take second order Taylor expansions, which will involve the cross-sectional variance of the price of different firms. Price dispersion is important for computing the welfare costs of inflation, as the price ratio is a convex function: by Jensen’s inequality, the mean of the function is larger than the function of the mean, so that price dispersion increases the value of the price ratio at that point. The larger the price dispersion, the greater the amount of labor required. This will, of course, lead to second-order welfare implications.

Inflation depends on the output gap, current and future. However, the reason for this is that the output gap is related to the markup gap. If output is higher than the natural level of output, then the average markup of the economy is below the desired markup. As we discussed, this leads to inflationary pressure.

The properties of the NK Phillips curve are, of course, pretty pleasing, but controversial. To begin with, it differs critically from the traditional Phillips curve. The traditional Phillips curve may be described in this typical formulation:

as in the traditional markup models from the 70s and 80s (where is the detrended or cyclical component of output). Obviously, this equation was backward looking, as a function of the past. Past inflation plays a clear role in determining current inflation. In contrast, in th NKPC, the past is irrelevant and inflation is purely forward looking.

The second property is sometimes referred to as Divine Coincidence: according to the NK model, there is no tradeoff between output gap and inflation stabilization (once again in clear contrast with the traditional Phillips curve). The tradeoff seems to be gone: if the central bank stabilizes inflation, this would automatically stabilize the output gap (suppose at 0), and vice versa. This is a very powerful result. Suppose a central bank cares about the output gap. The gap is output minus the natural level of output, which is however not observable but purely counterfactual (it assumes flexible prices). How to address the output gap if this is not observable? This challenge is rescued by the Divine Coincidence: if inflation is stabilized — with inflation being naturally observed — then output gap will also be stabilized. More specifically, to completely close the output gap, it would enough (in the limit) to set inflation equal to 0 at all times.

Finally, as a conclusive comment: The difference between the NK and the traditional Phillips curve is that in the NK the notion of output gap is more precise, and theoretically grounded: it is exactly the gap between current output and the equilibrium output with flexible prices. Traditional output gap, very differently, usually referred to the detrended output , which is usually current output minus some statistical function of time that captures low frequency movements in output. It is a purely statistical magnitude with no theoretical justification. This kind of measure is usually used in empirical versions of the Phillips curve, and many economists still use output gap referring to this object. To our purposes, however, it is worth noting that the value of these two different “output gaps” may be extremely different: the natural level of output responds to many shocks and may be very different from its smooth function over time. In Galì (2003), some comparison is offered, focusing on the 90s US economy: productivity growth was high, with an increase not only in ouput, but also in the natural level of output. Thus, the output gap was stable, while the traditional output gap was skyrocketing. To further support this idea, inflation was stable in the 90s, and not increasing, as the traditional Phillips curve should have required.

Empirical Evidence

What alternatives can be proposed to measure the NK Phillips curve? Using the markup gap and exploiting the fact that the markup gap is inversely related to the labor income share, that we directly observe, it is possible to obtain the desired measure.

The labor income share

The labor income share evolves according to the technology fundamentals and the markup, but only if the previous assumptions on the production function are taken seriously. If firms don’t pay workers the marginal product of labor, but less than it, the markup gap will be higher.

Note that this line of reasoning hinges upon the assumption that the marginal product of labor is a truthful, meaningful economic object. Once the assumptions on the production function are modifies or relaxed, then, a jar is opened where other interpretations of the output gap become acceptable: such as conflict inflation, or a CES production function or other technological assumptions.

Under rational expectations, the error term in the expected and realized inflation should be orthogonal to such observable features. The only free variable is , which can be pinned down by introducing some assumptions on and . The specific assumption is and , which pins down . Moreover, the implied average duration is similar to the one empirically observed in EU and US. In the same paper, a new version of the NK Phillips curve is estimated, known as the hybrid NK Phillips curve or augmented NK Phillips curve:

where some role is granted to past inflation. This can be generate if a fraction of firms adjust prices according to a rule of thumb which is based on previous inflation. Alternatively, through models with price indexation, where some random share of firms adjust optimally and some others adjust according to the rule of thumb (this turns out not to be a bad rule: it accounts for the fact that other firms are optimizing). These techniques have been critized due to weak instruments. As on the empirical side, a puzzle is related to missing deflation (Stock and Watson 2020), since during the Great Depression contradficts the traditional Phillips curve: output gap was low but inflation remained still despite rising unemployment.

The Dynamic IS equation

In equilibrium, market clearing ensures that . Combine the (log-linearized) Euler equation (^9b6ba8) and goods market clearing:

The New Keynesian Phillips curve is written in terms of the output gap; therefore, transform the Euler equation by subtracting the natural level of output from both the RHS and LHS. On the LHS, also the expected natural level of output is subtracted and added:

Finally, move the middle term inside the expectation, and exploit the definition of . In the additional line, exploit the expression for , assuming equilibrium in expectation and assuming tha follows a AR(1) process:

The is the natural interest rate that would prevail in equilibrium under flexible prices, which corresponds exactly to the real rate in the Classical model. How to know that this is the correct interpretation? On the one hand, it can be solved on equilibrium under flexible prices — as did in Chapter 2 — and yield the same result (a “brute force” approach). Alternative and more simply, suppose prices were flexible and note that the output gap would be equal to 0: thus, would be equal to the real interest rate. This is a key argument in the design of monetary policy.

An important feature of the Dynamic IS equation is that it can be iterated forward making clear that the output gap is a forward looking variable, depending on current and future interest rates gaps — gaps between the interest rate and the natural rate of interest.

This implies that the central bank can influence today’s output gap by influencing either the interest rate today or expectation of future interests. This plays a crucial role not only in theory, but in central banking practice, especially when an economy is operating around the zero lower bound.

Equilibrium

Equilibria in the NK model can take different forms, depending on how the central bank conducts monetary policy. On top of that, monetary policy may involve more than one equation. For instance, if some rule for the money supply is also followed, two equations would be needed: given three endogenous variables and the previous two equations, we add another variable — the money supply — and thus need four equations for four unknowns. The additional equation would describe the equilibrium in the money market, and relating money supply to the money market .

Money supply

In this version, there is no reference to money. This is sometimes referred to as the cashless version of the NK model. An implication is that money demand shocks of the type are irrelevant. The idea is that the money demand shock leads the central bank to adjust the money supply 1-to-1 to the money demand shock, leaving all other variables unchanged: Of course, this result depends on the fact that the central bank follows an interest rate rule, and not a money supply rule. The difference equation prescribes the money supply rule required in equilibrium to implement the same interest rule as before.

For our purposes, however, assume that the central bank follows an interest rule such as the standard interest rate rule (note that this is not yet the optimal rule, and rather it is a simple, realistic rule that we assume):

where is an exogenous monetary policy shock. Note that this is expressed in terms of output (namely, deviations of output from the SS). In contrast, we rewrite the sheer output deviations in terms of the output gap and endogenous shocks:

where:

It is now possible to solve the system of three difference equations with three endogenous variable (the nominal rate, inflation, and the output gap). Any solution to this system is a valid equilibrium.

This system is normally simplified by omitting the nominal rate rule. After combining the NKPC, the Dynamic IS curve, and a nominal rate rule, this can be rearranged in the canonical representation of the equilibrium dynamics:

where the subscript suggests that this result is conditional on some interest rate rule ( stands for Taylor). These are as follows:

The condition for existence and uniqueness of equilibrium is that the number of eigenvalues within the unit circle is the same as the number of non-predetermined variables and the number of eigenvalues outside the unit circle is equal to the number of predetermined variables (although stated in reverse relative to Blanchard and Kahn, that is the same intuition). Thus, we need both the eigenvalues corresponding to the endogenous variables to be inside the unit circle. As shown by Bullard and Mitra (2005), the condition to be met for this to be true is the following:

Intuitively, this is saying that must be large enough: monetary policy should be sufficiently aggressive to react to fluctuation in output and inflation. This recalls the Taylor principle in the classical model, for : this can be relaxed slightly when the central bank also responds to output. For any reasonable calibration, however, is usually very small, making the impact of negligible.

If the conditions for equilibrium are not satisfied, we could have sunspot fluctuations. However, in contrast to the classical model, these will affect both inflation and output gap, therefore they also affect some real variables (output, employment, real wage…). This makes the NK case more serious that the classical model if the problem of indeterminacy arises.

To continue, suppose the uniqueness conditions are satisfied and solve for this unique equilibrium. In general, models of this kind cannot be solved by hand, and typically software is used, such as Dynare. Assume that and and exploit the method of undetermined coefficients (note that this method if meaningless if the equilibrium is not unique). Take the NK Phillips curve and the Dynamic IS equation and substitute with the previous coefficients.

The method starts by conjecturing the terms of the solution:

Undetermined Coefficients

If the exogenous variables follow a AR(1), the correct conjecture looks like the previous one (the endogenous variable change is proportional to the endogenous volume of the shock). Impose the conjecture on the previous two equations:

These are two linear equations in two unknowns, solved trivially by substitution. The solution returns two negative coefficients. This implies that monetary policy is not neutral: it affects the output gap and output thereof.

In the general case, conjectures for undetermined coefficients appear to be as follows:

Undetermined Coefficients

is a credible conjecture since the model is linear and there is no interaction between the shocks. Then, solve shock by shock.

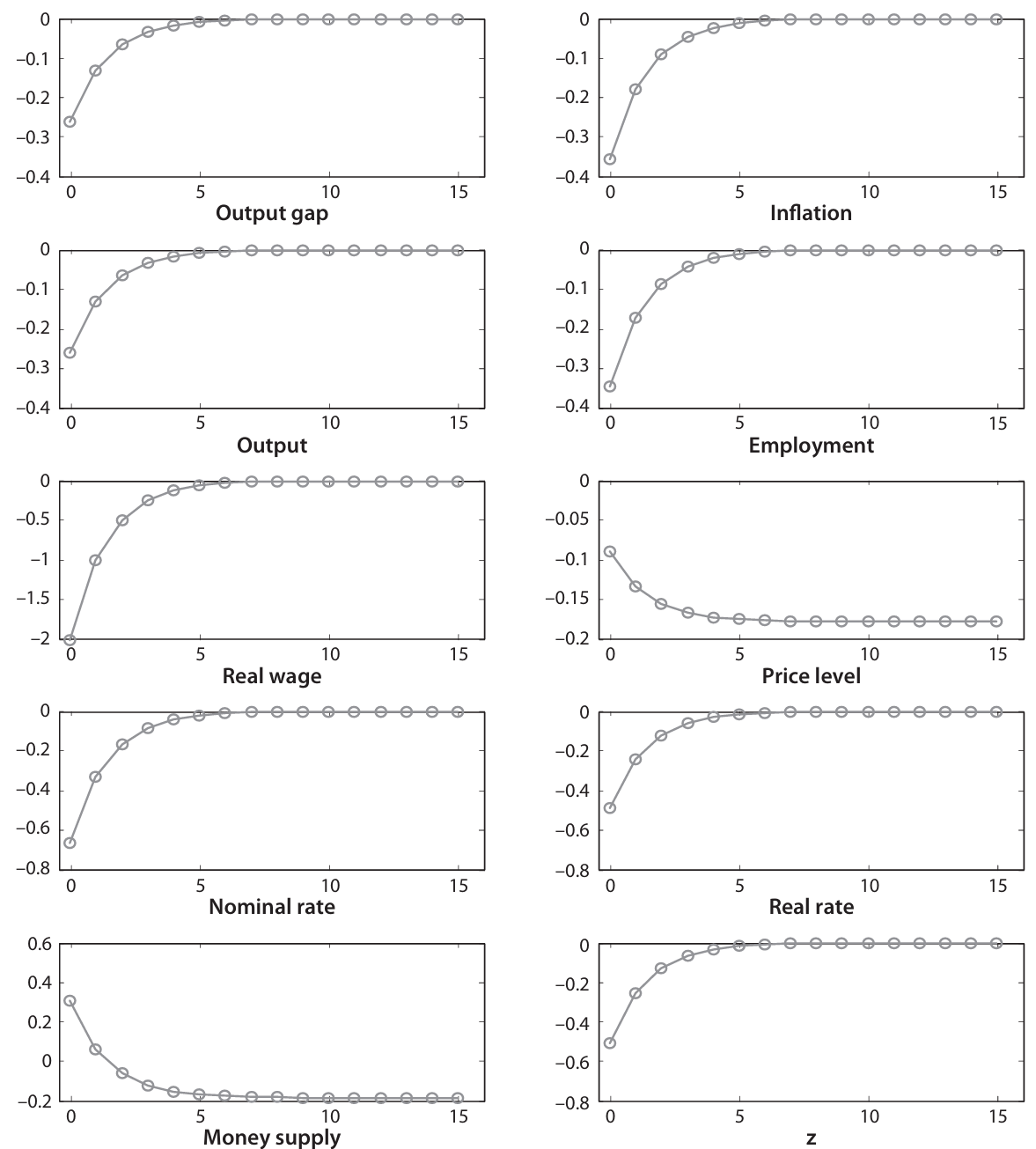

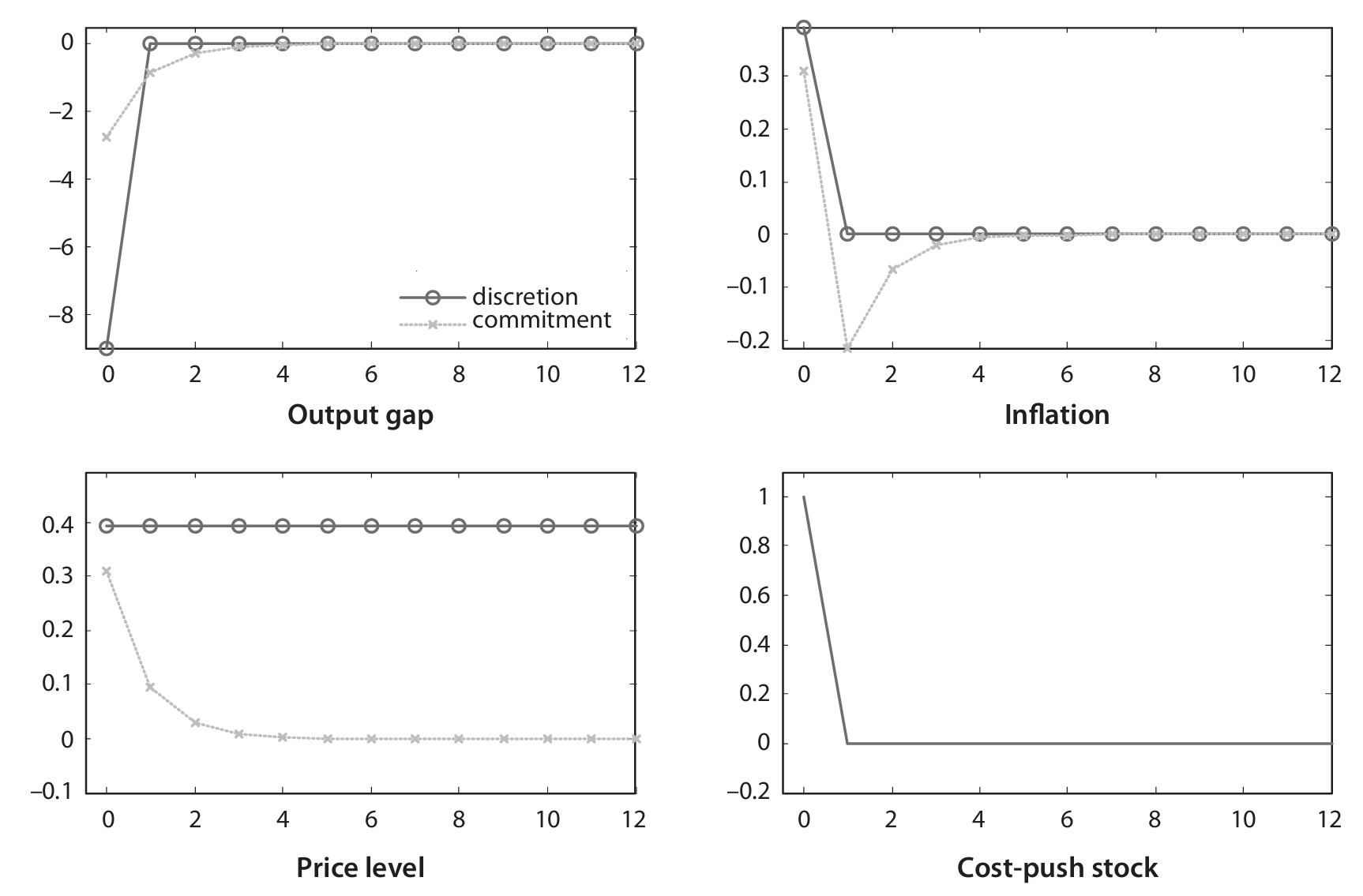

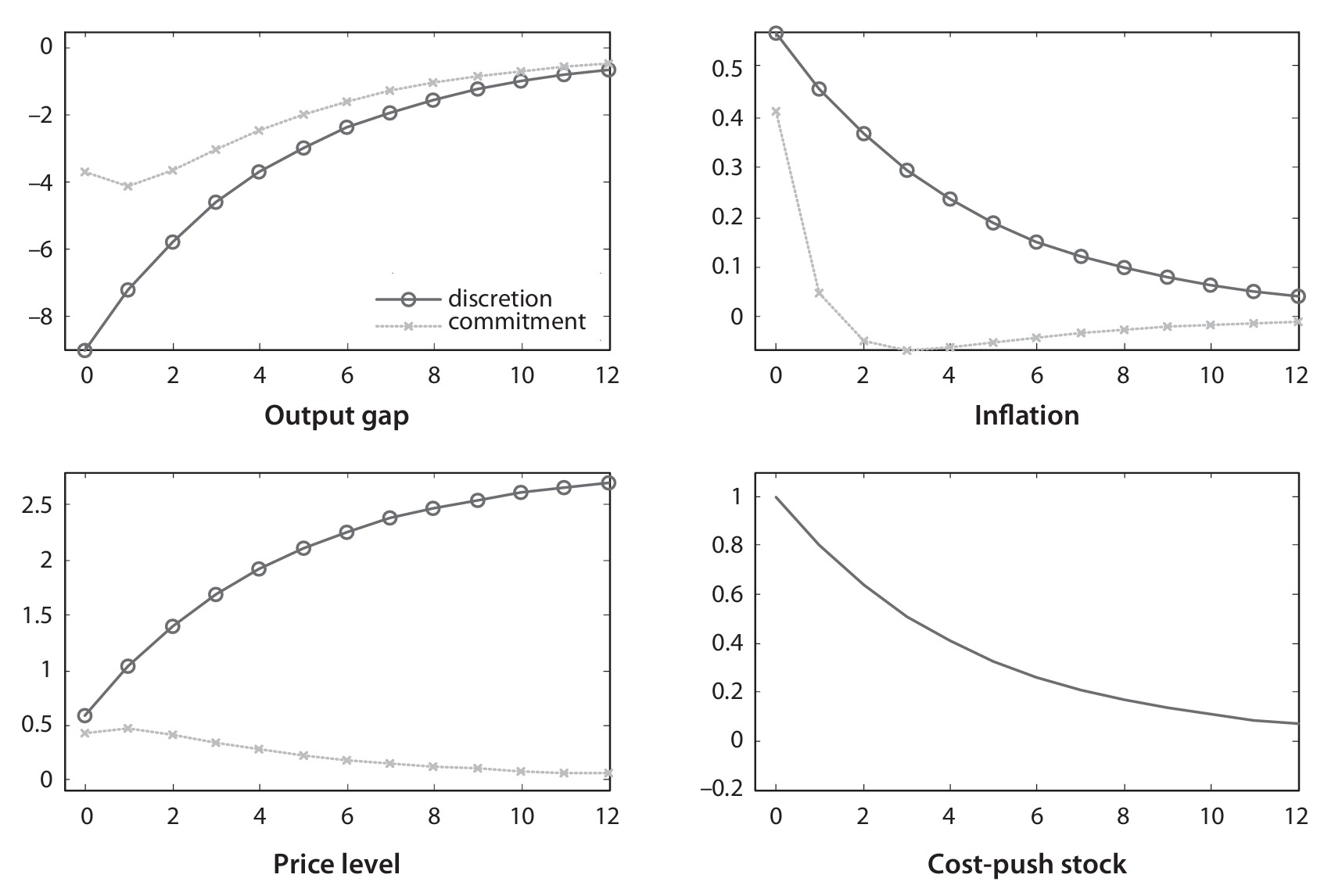

IRF: Monetary policy shock

Impulse response functions to a monetary policy shock from a calibrated version of the model allow to discuss some salient results. An increase of 1% in the interest rate in annualized terms increases the exogenous component by 1%, but output and endogenous variables decrease, so that the final increase in the real interest rate is lower than 1%. In contrast with the classical model, monetary policy shocks and the real interest rate move in the same direction.

The monetary shock utilized for the IRF functions takes the form of an increase of 25 base points in . The increase in the real rate induces effects on consumption through the Euler equation, and thus on aggregate demand and output. This is reflected in the IS equation, where current output gap depends on current and future variables.

The output gap drops, and obviously inflation as well, being related to the output gap. The natural level of output does not change, also reflecting the fact that the output gap is shocked. The real wage also decreases unambiguously, moving down along the labor supply schedule. To solve for the price level, solve and note that the price level decreases very gradually until stabilization. This is consistent with negative inflation: ultimately, prices stabilize permanently at a lower level (recall, from previous passages, that there is no steady state for prices). To understand this, imagine that a firm sees decreasing demand for their goods: their response will be not only to produce less, but will also lead to lower marginal costs (decreased wage and increased marginal product of labor). Therefore, when they get a chance to adjust prices, they will try to lower prices. Finally, note that money supply also converges to the initial value.

The three predicitons of the classical model conflicting with the empirical evidence are now reversed: non-neutrality of monetary policy, gradual adjustment of the price level, and liquidity effect as all there. The real interest rate is affected by the nominal interest rate because inflation does not move 1-to-1 with due to price stickiness.

IRF: Preference shock

A negative shock to should be interpreted as a negative preference shock: consumers prefer to consume less at the time of the shock. The variables on the column on the left react just the same as in the monetary policy shock, with the exception of the nominal rate and the money supply.

The nominal rate reacts differently through the endogenous component of the policy rule. Inflation and output decrease, and thus the central bank lowers the interest rate. Whenever the nominal rate goes down, so does the real rate, as inflation does not change much. This occurs as an attempt to stabilize the economy, to partly offset the declining demand coming from the preference shock. However, this is not fully offset and the output goes down, although the decrease would have been even larger without the policy intervention.

The money supply goes up in the short run, but not in the long run, because of the lower nominal interest rate. Given this calibration, it tends to offset: , where the first two decrease and the latter increases. For the point of view of the individual firm, this shock looks similar to the monetary policy shock.

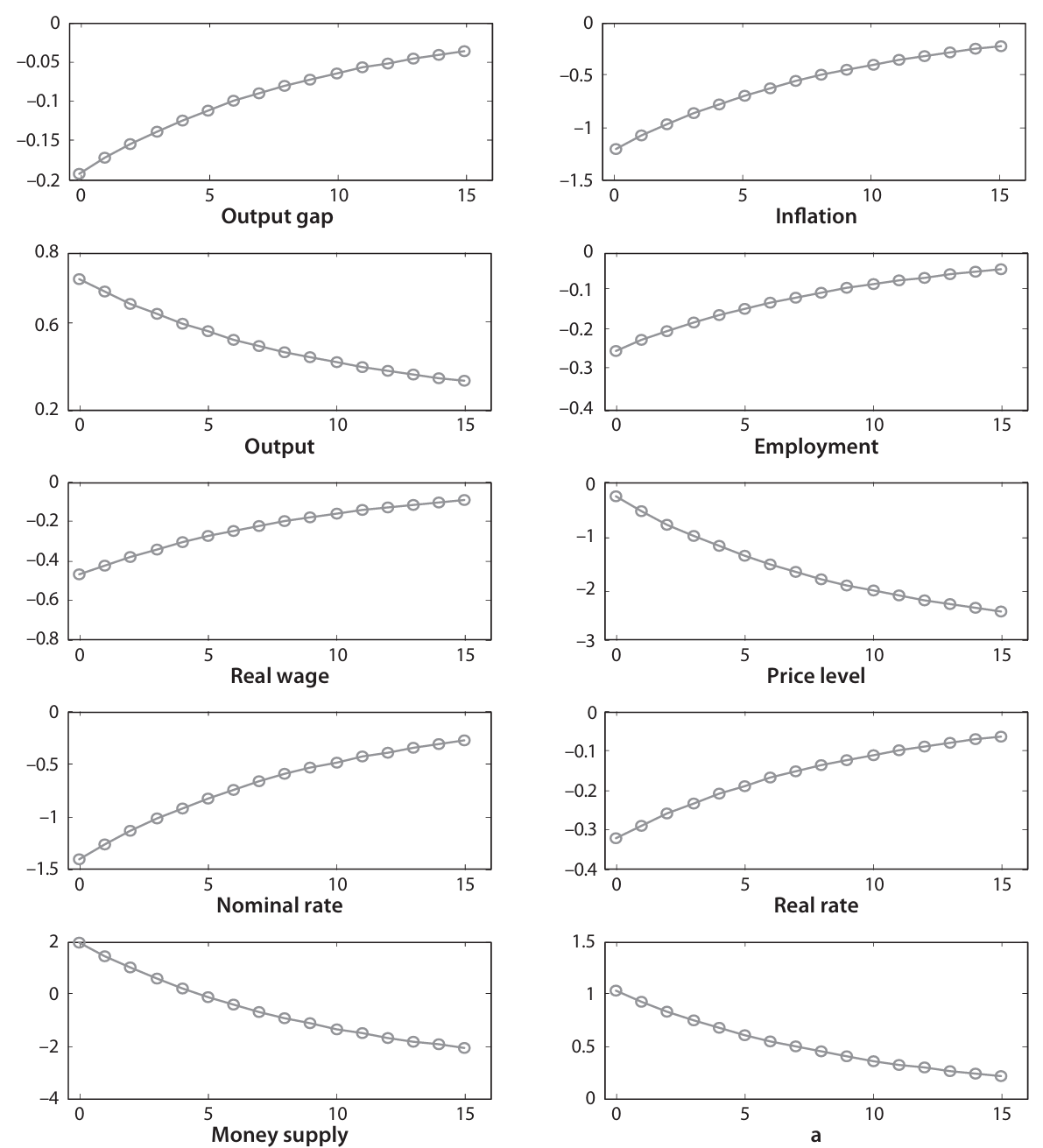

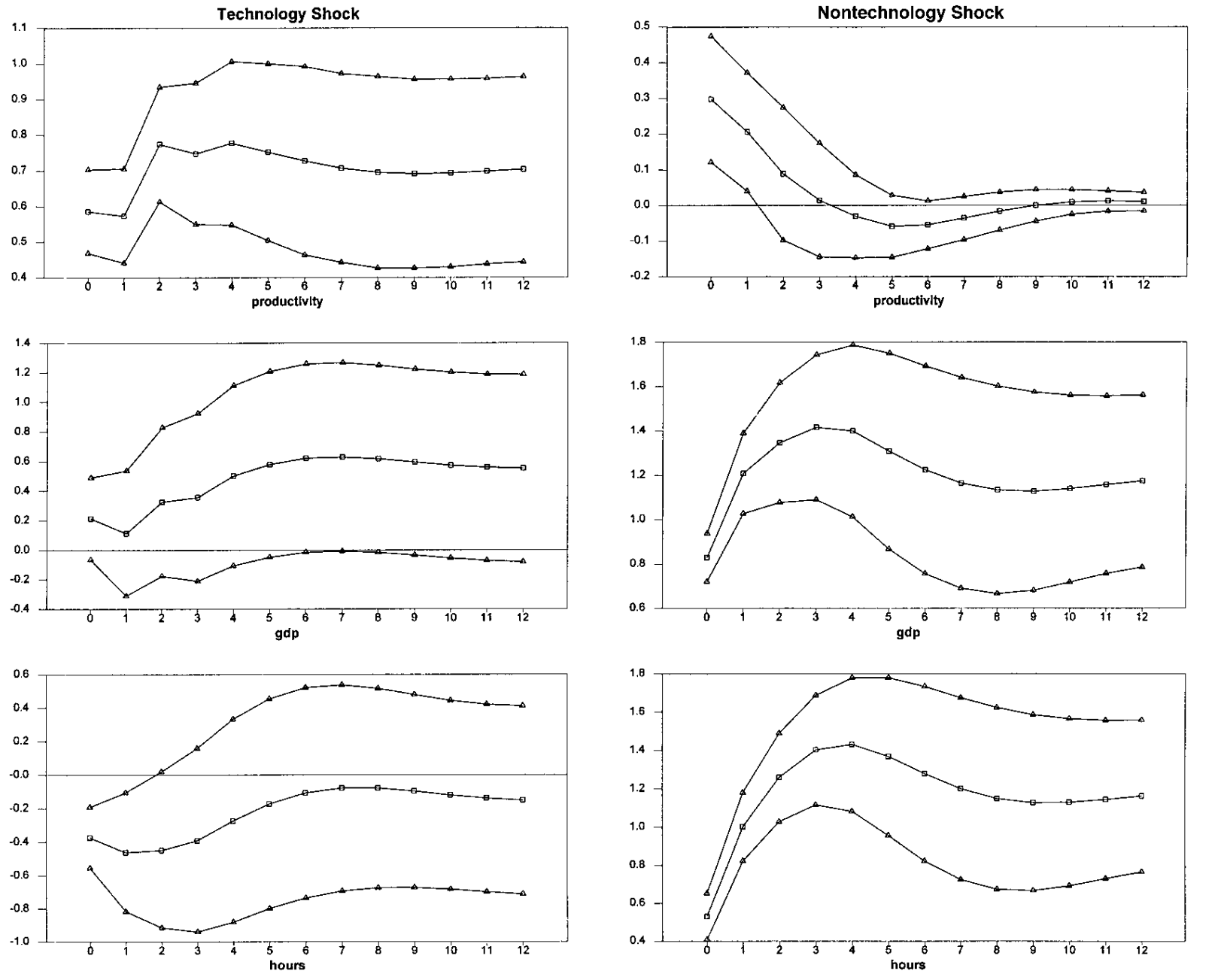

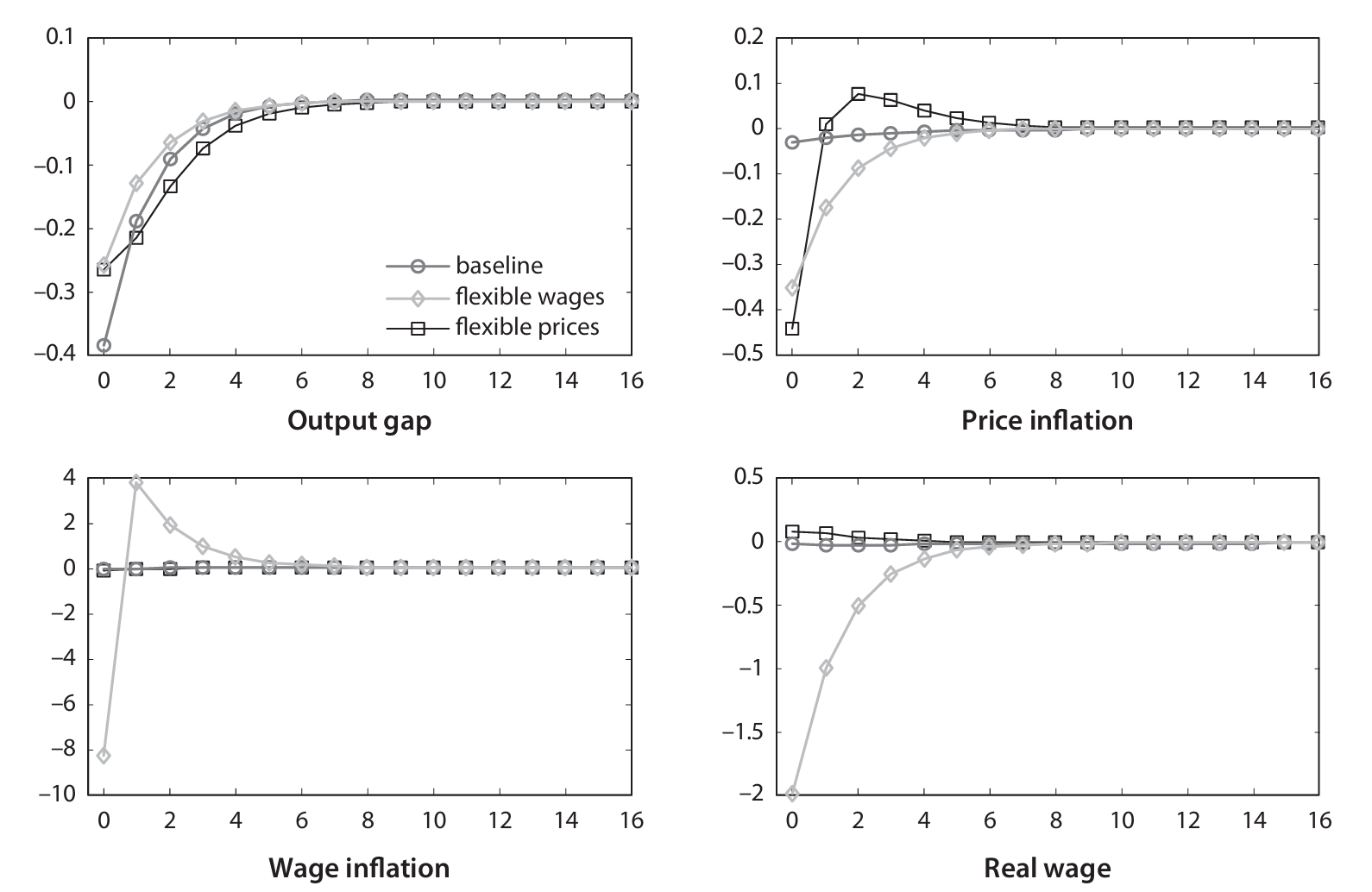

IRF: Technology shock